Schedule C is an IRS tax form that reports profit or loss from a business. It’s typically used by sole proprietors or single-member LLCs.

Updated Aug 12, 2024 · 2 min read Written by Tina Orem Assistant Assigning Editor Tina Orem

Assistant Assigning Editor | Taxes, small business, Social Security and estate planning, home services

Tina Orem is an editor at NerdWallet. Prior to becoming an editor, she covered small business and taxes at NerdWallet. She has been a financial writer and editor for over 15 years, and she has a degree in finance, as well as a master's degree in journalism and a Master of Business Administration. Previously, she was a financial analyst and director of finance for several public and private companies. Tina's work has appeared in a variety of local and national media outlets.

Lead Assigning Editor Chris HutchisonChris Hutchison helped build NerdWallet's content operation and has worked across banking, investing and taxes. He now leads a team exploring new markets. Before joining NerdWallet, he was an editor and programmer at ESPN and a copy editor at the San Jose Mercury News.

Fact Checked

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

If you freelance, have a side gig, run a small business or otherwise work for yourself, you may need to fill out IRS Schedule C at tax time. Here’s a simple explainer of what IRS Schedule C is for, who has to file one and some tips and tricks that could save money and time.

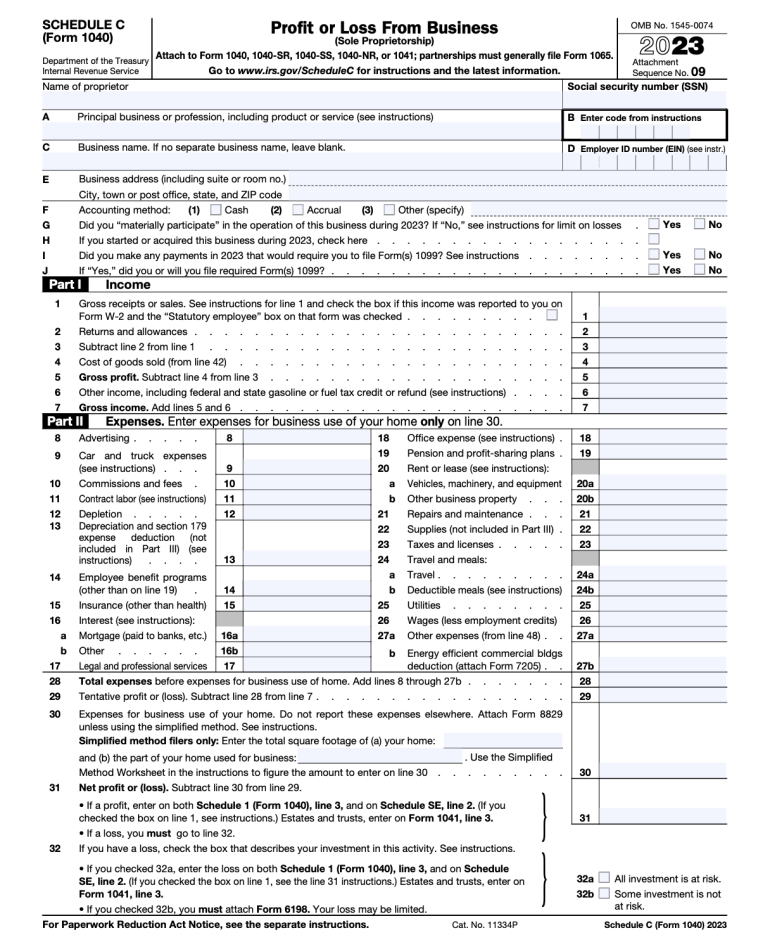

IRS Schedule C is a tax form for reporting profit or loss from a business. You fill out Schedule C at tax time and attach it to or file it electronically with Form 1040 . Schedule C is typically for people who operate sole proprietorships or single-member LLCs.

A Schedule C is not the same as a 1099 form . Although, you may need IRS Form 1099 (a 1099-NEC or 1099-K in particular) in order to fill out a Schedule C.

Simple tax filing with a $50 flat fee for every scenario

With NerdWallet Taxes powered by Column Tax, registered NerdWallet members pay one fee, regardless of your tax situation. Plus, you'll get free support from tax experts. Sign up for access today.

Register Nowfor a NerdWallet account

Hassle-free tax filing* is $50 for all tax situations — no hidden costs or fees.Maximum refund guaranteed

Get every dollar you deserve* when you file with this tax product, powered by Column Tax. File up to 2x faster than traditional options.* Get your refund, and get on with your life.*guaranteed by Column Tax

Schedule C is for two types of businesses: sole proprietors or single-member limited liability corporations (LLCs). Schedule C is not for C corporations or S corporations.

Sole proprietorships are unincorporated businesses that are owned and run by one person who is entitled to all of the profits and is responsible for all of the losses and liabilities. They're often the choice of people who freelance, have a side gig, are independent contractors or operate a business by themselves.

Single-member LLCs are business entities owned by just one person. In most cases, there’s no distinction between the owner and the LLC for income tax purposes; the business’s income and profits go right onto the owner’s personal tax return.

You may have to file a Schedule C even if you have a regular day job where you’re someone’s employee. So if you’re freelancing on the side, your self-employment means you’ll probably need to add the Schedule C to your to-do list.

For tax purposes, the IRS says you’re in business if you’re pursuing your gig continually and regularly in order to make money.

If your side gig involves rental income or royalties, you may need to fill out Schedule E . If your side gig is farming, you may need to fill out Schedule F.Schedule C is a place to report the revenue from your business, as well as all the types of expenses you incurred to run your business. Your business income minus your business expenses is your net profit (or loss). You report your net profit as income on Form 1040.

Here's some information you’ll need:

Your business income statement and balance sheet for the tax year. Receipts for your business expenses. Inventory records, if you have inventory. Mileage and other vehicle records if you used one for business.Here's the basic structure of Schedule C:

Part I is where you tally your sales and report your cost of goods sold so you can see your gross profit.

Part II is where you report your business expenses. There are over a dozen categories to help you stay organized, such as advertising, car and truck expenses, legal and professional services, rent, travel and meal expenses and other costs. The IRS' Schedule C instructions page explains the rules for each type of expense [0]

Internal Revenue Service . Instructions for Schedule C. Accessed Aug 12, 2024.. You’ll add up all the expenses and subtract them from your gross profit to arrive at your net profit, which is taxable income for your personal tax return. If you have a net loss, it may be deductible on your personal tax return.

Part III helps you calculate your cost of goods sold.Part IV is a place to report certain information on a vehicle if you have car- or truck-related business expenses.

Part V is a place to list other business expenses that didn’t fit into the categories in Part II.

Most name-brand tax software providers sell versions that can prepare Schedule C. Although you’ll likely need to purchase the highest-end version to get Schedule C functionality, that still might end up costing less than paying someone else to do your taxes.

You may need to fill out more than one Schedule C. It’s one Schedule C per side gig. So if you have two side gigs, you’ll need to fill out two Schedule Cs.

Measure your home office’s square footage. If you have a home office, you can probably deduct some expenses associated with keeping it up and running if you’re self-employed. The IRS offers a flat-rate deduction of $5 per square foot for up to 300 square feet of home office space. But if a big percentage of your home’s square footage is dedicated to your home office and your home expenses (utilities, etc.) are high enough, and you're able to keep and compare detailed records, you might get a bigger deduction with the “regular” method.

Simple tax filing with a $50 flat fee for every scenario

With NerdWallet Taxes powered by Column Tax, registered NerdWallet members pay one fee, regardless of your tax situation. Plus, you'll get free support from tax experts. Sign up for access today.

Register Nowfor a NerdWallet account

Learn MoreBe sure to take advantage of other tax deductions. Self-employment can score you a lot of tax deductions , and one of the newest is the qualified business income deduction. If you qualify, you can deduct up to 20% of your business’s net income on your tax return. See if you can take this deduction.

Make estimated quarterly tax payments to avoid penalties. Taxes are a pay-as-you-go arrangement in the United States; when you earn money, the IRS wants its cut as soon as possible. That’s why employers withhold taxes from employee paychecks. But when you’re paying yourself, that’s probably not happening. To avoid late-payment penalties, you can make estimated quarterly payments to the IRS.

About the authorYou’re following Tina Orem

Visit your My NerdWallet Settings page to see all the writers you're following.

Tina Orem is an editor at NerdWallet. Before becoming an editor, she was NerdWallet's authority on taxes and small business. Her work has appeared in a variety of local and national outlets. See full bio.

On a similar note.

Smart money moves for your business Get access to business insights and recommendations, plus expert content.

Sign up for free MORE LIKE THIS Small-Business Taxes Tax forms Tax preparation and filing Small Business Taxes

Download the app

Disclaimer: NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions. Pre-qualified offers are not binding. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly.

NerdUp by NerdWallet credit card: NerdWallet is not a bank. Bank services provided by Evolve Bank & Trust, member FDIC. The NerdUp by NerdWallet Credit Card is issued by Evolve Bank & Trust pursuant to a license from MasterCard International Inc.

Impact on your credit may vary, as credit scores are independently determined by credit bureaus based on a number of factors including the financial decisions you make with other financial services organizations.

NerdWallet Compare, Inc. NMLS ID# 1617539

California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License #60DBO-74812

Insurance Services offered through NerdWallet Insurance Services, Inc. (CA resident license no.OK92033) Insurance Licenses

NerdWallet™ | 55 Hawthorne St. - 10th Floor, San Francisco, CA 94105